Empower retirement calculator

Calculate the premiums for the various combinations of coverage and see how choosing different Options can change the amount of life insurance and the premiums. Build Your Future With a Firm that has 85 Years of Investment Experience.

Empower Retirement Me My Money Calculators Pension Calculator

Ad Get Personalized Action Items of What Your Financial Future Might Look Like.

. Each calculation can be used individually for. To discuss your results in greater detail and for a more in-depth financial analysis use the contact form provided and a CFS Financial Advisor will contact your shortly. This calculator will help you determine what your required minimum distributions will be under IRS rules.

If you are 70½ or older the calculator will estimate your next distribution. Calculators Borrowing from your employer retirement plan Print Borrowing from your employer retirement plan Understand the impact of taking a loan from your employer sponsored retirement account. For government education healthcare and not-for-profit plans.

If you cash in your plan assets before you reach age 59½ youll potentially face steep taxes which can reduce your payout significantly. Percent of current salary you may need for this retirement lifestyle 102 102 of your current salary. Empower Retirement - Learning center - Calculators - Minimum required distributions Home Calculators Minimum required distributions Print Minimum required distributions Understand when you will be required to begin withdrawing from your retirement savings and how much you will need to withdraw each year.

Enter 0 if you do not plan to contribute while the loan is outstanding. Home financial retirement calculator. Lump-sum distribution after taxes and penalties.

Note that the maximum employee contribution for 2021 is 19500 or 26000 if you are over age 50. If you are a new SERS member you have 45 days to choose one of three retirement plan options. Current AgeYour age today.

Years until retirement 1 to 50 Current annual income. Free calculators that help with retirement planning with inflation social security life expectancy and many more factors being taken into account. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement.

Your lifestyle choices may have implications for your spending in retirement. Estimated length of retirement you could fund. With the Retirement Planner tool easily estimate how much you will need for retirement in just 5 simple steps.

New Member Plan Comparison Calculator. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. AARPs Free 3-Minute Chat Can Help You Plan Your Income For When You Retire.

The results and findings presented by this calculator may vary due to user input and assumptions. A Retirement Calculator To Help You Plan For The Future. What age do you plan to retire.

Your required minimum distribution for 2039. Our financial professionals can help you plan today. Empower Retirement - Learning center - Calculators - Withdrawals in retirement Home Calculators Withdrawals in retirement Print Withdrawals in retirement Understand the impact that annual withdrawals may have on your retirement account so you can estimate how many years your savings may last.

MassMutuals retirement calculator can help you better prepare for your retirement. Our Retirement Calculator can help a person plan the financial aspects of retirement. Your current age 1 to 120 Current annual income Spouses annual income.

The results and findings presented by this calculator may vary due to user input and assumptions. Empower Retirement contracts with SERS to offer the deferred. Planned Retirement AgeThe age when you plan to begin withdrawing money from your retirement account.

Evaluate how the life insurance carried into retirement. Retirement and Financial Planners. Balance at retirement if account rolled over.

Borrowing from your savings may provide solutions in the near term but could negatively impact investment growth and cost you in loan fees. Use this retirement calculator to see if your portfolio is likely to support your retirement goals. Auto Loan Calculator Retirement Savings and Planning Savings Calculators Mortgage Calculators Pages within Tools Education Auto Center.

Holders of traditional IRAs and other tax-deferred savings accounts are required to take minimum distributions once they reach age 70½. Cashing out could cost you. Use this calculator to estimate how your lifestyle choices in retirement as compared to your current lifestyle may affect your expenses.

Once youve entered your information the tool will display your retirement income projections and tips for closing any savings gaps. This calculator will estimate retirement benefits for all three options to help you better understand them. How much do you and your employer plan to contribute per pay period while repaying the loan.

Federal Employees Group Life Insurance FEGLI calculator. You may want to think twice. Calculators With our powerful easy-to-use financial calculators you can dig into the data and figure out the best course of action when it comes to spending saving and investing your money.

Empower Retirement - Early Payout Calculator Early Payout Thinking of taking an early payout from your employer-sponsored retirement savings plan. Determine the face value of various combinations of FEGLI coverage. To discuss your results in greater detail and for a more in-depth financial analysis use the contact form provided and a CFS Financial Advisor will contact you shortly.

Retirement Calculator See how small changes today could affect your retirement success.

Kpao9cnopd Xvm

Empower Retirement

Account Signup Massmutual

Empower 401k Reviews

Empower Retirement Vs Fidelity Labs Comparably

Empower Retirement Retiree Crossroads

Account Signup Massmutual

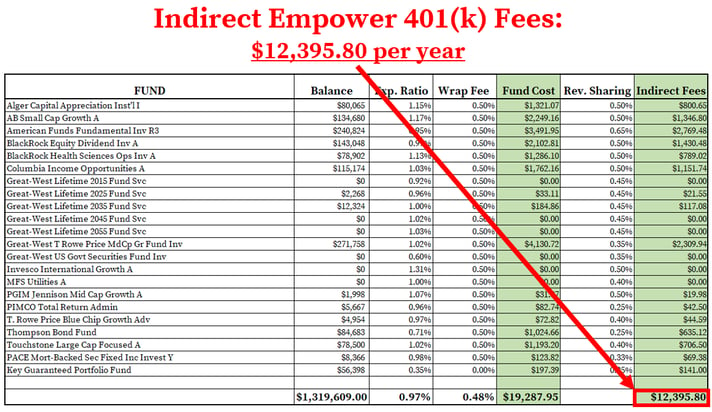

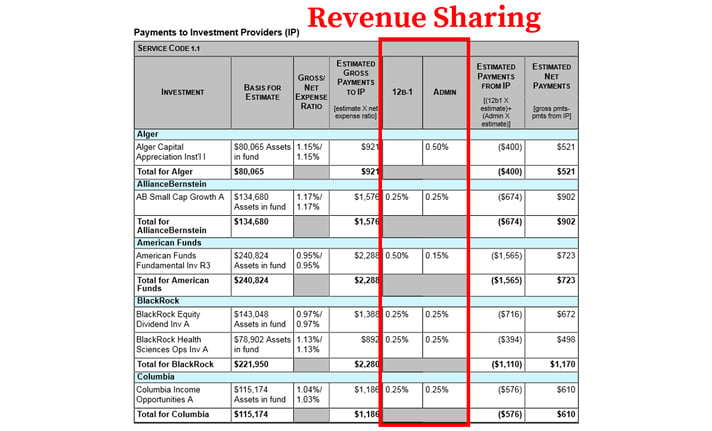

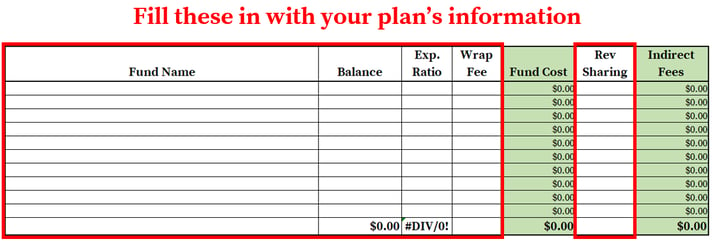

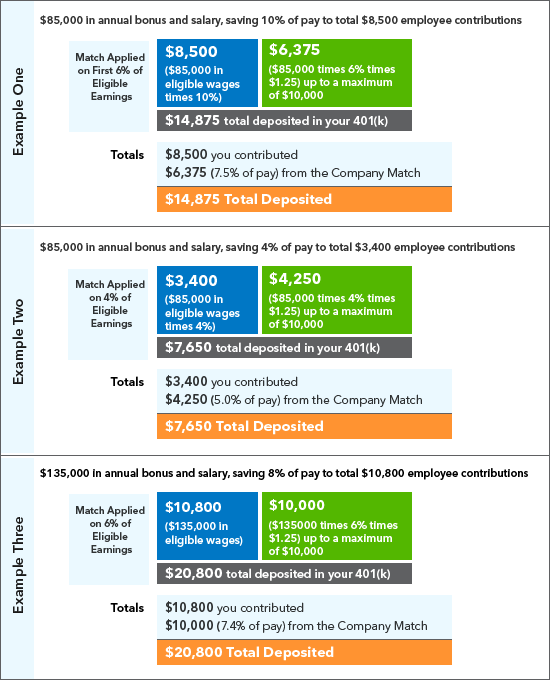

How To Find Calculate Empower 401 K Fees

2

How To Find Calculate Empower 401 K Fees

How To Find Calculate Empower 401 K Fees

Soonersave Opers

Empower 401k Reviews

Empower Retirement Company Culture Comparably

Empower Retirement Nps Customer Reviews Comparably

401 K Savings Plan Intuit Benefits U S

Ak Drb Health Plan Service Partners